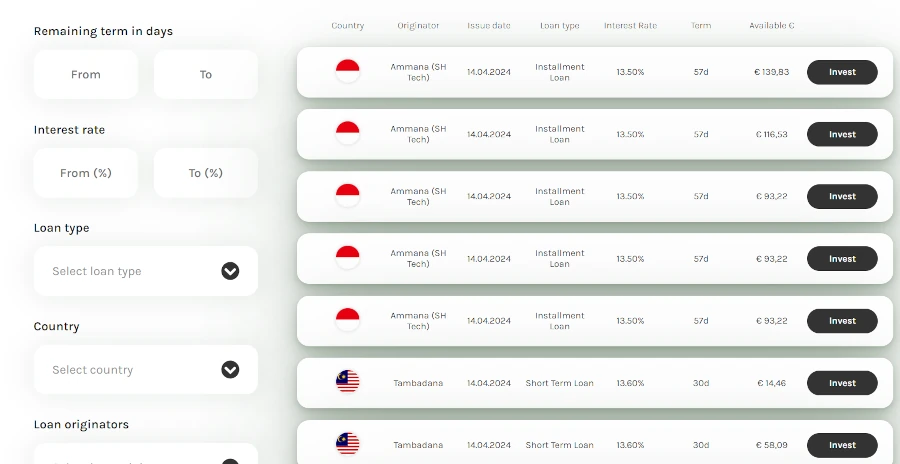

Loanch is an investment platform that allows financing of short-term loans in Asia. The loan issuers are Ammana in Indonesia, Tambadana in Malaysia, and Ceyloan in Sri Lanka. The target rates are 13.50%. Loanch.com offers loans to individuals for consumption, home renovation, or other unexpected expenses. The loan duration is between 30 days and 90 days. The investor can choose loans individually or let the platform manage investments through strategies. There is a buy-back protection for loans that are 30 days overdue. The platform is relatively new. It was launched in 2023. It is registered in Hungary.

Loanch allows investing in two ways: either by choosing predefined strategies or by choosing loans manually. Here are the loans available on the platform at the time of this analysis.

Loanch has chosen to stand out by offering loans located in Southeast Asia. The rates are high, but it will be necessary to monitor delays, definitive losses, and the activation of the 'Buy Back' security in case of delays of more than 30 days. Exposure to the Asian geographical area can be interesting as part of a geographical diversification of one's loan portfolio. Since the loans are in euros, the exchange rate risk is borne by the platform.

The investor holds a simple fixed-rate loan. It is a classic debt instrument for peer-to-peer personal loans (P2P). They pay interest fixed at issuance according to a predefined periodicity until maturity.

This review is proposed by Damien Cuyala on

This review is proposed by Damien Cuyala on

Loanch est une plateforme d'investissement qui permet de financer des prêts court-terme en Asie.

Les taux cibles sont de 13.50 %. Loanch.com propose des prêts aux particuliers pour de la consommation, la rénovation des habitations ou d'autres dépenses inattendues.

La durée des prêts est entre 30 jours et 90 jours. L'investisseur peut choisir individuellement les prêts ou bien laisser la plateforme gérer les investissements aux travers de stratégies. il existe une protection de rachat (buy back) pour prêts en retard de 30 jours. La plateforme est relativement récente. Elle a été lancée en 2023. Elle est enregistrée en Hongrie.

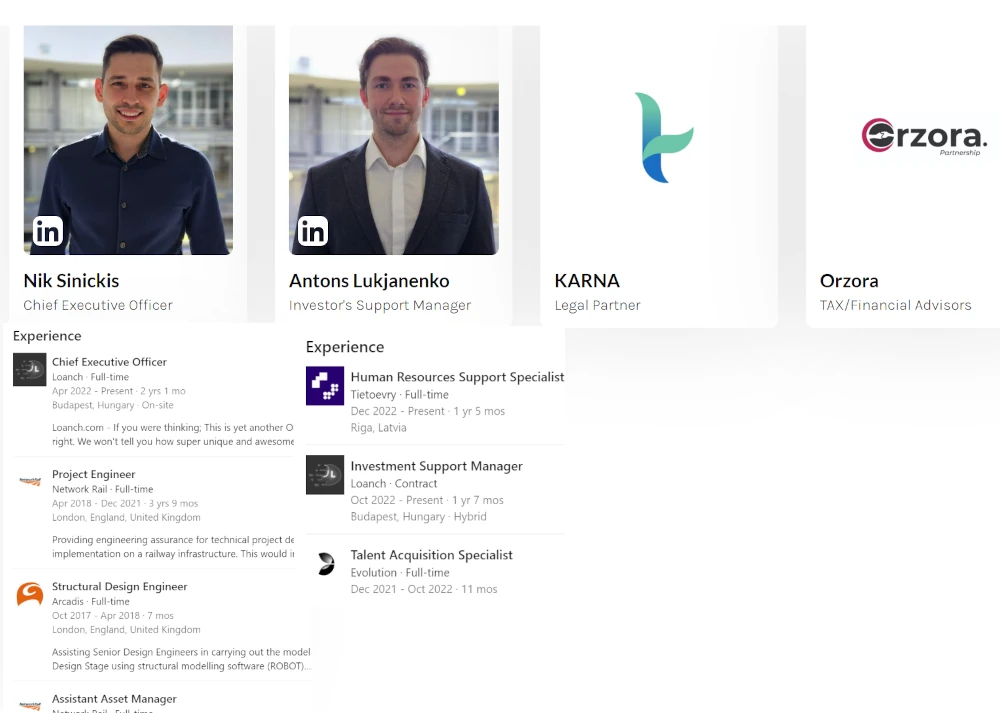

Les fondateurs sont Nik Sinickis et Antons Lukjanenko. Le CEO a une expérience d'ingénieur à Londres. L'équipe est jeune. Les fonctions juridiques, fiscales et IT sont externalisées chez des spécialisés : Karna, Orzora et Finriser.

Il y a 4.60M€ de montant total investi sur cette plateforme

Montant de projets en retard de plus de 6 mois : 0 + évolution depuis la dernière analyse

Montant de projets en perte de définitive : 0 + évolution depuis la dernière analyse

Actualité de la plateforme : L'entreprise est enregistrée en Hongrie au nom de RiseTech Korlátolt Felelősségű Társaság. Non régulée au niveau européen.

Actualité sur les émetteurs de prêts : Les émetteurs de prêts sont Ammana en Indonésie, Tambadana en Malaisie et Ceyloan au Sri Lanka.

Evolution du nombre de prêts totaux mensuels de la plateforme : Environ 87000 euros par mois

rendement moyen : 13%

Total des intérêts payés : Pas d'information pour le moment.

Montant total investi : 4,6M€ + augmentation/diminution

Montants investis par les investisseurs mensuellement : Entre 50K€ et 88K€ / mois

Santé financière de la plateforme (Rapport financier si il existe) : Pas d'information pour le moment.

Je n'investis pas pour le moment sur cette plateforme. Je pense investir très prochainement sur la société de crédit Tambadana.

The founders are Nik Sinickis and Antons Lukjanenko. The CEO has engineering experience in London. The team is young. The legal, tax, and IT functions are outsourced to specialists: Karna, Orzora, and Finriser

The average expected yield of projects is 13%

Yields are calculated based on the projects analyzed on this site and not on all projects.

⚠️ The higher the yield, the higher the risk.

✅ Loanch has a buy back guarantee

In P2P lending A buyback guarantee is a guarantee provided by a loan originator regarding a specific loan. If repayment of that particular loan is delayed by more than a specified number of days (usually 60), then the loan originator is obligated to buy back the loan.

⚠️ Information about delays of more than 6 months is not available for Loanch

⚠️ Information on permanent losses is not available for Loanch

The minimum amount to invest is 10€.

Loanch has a very low minimum amount to invest

🌎 The financial income are taxable in the investor's country of tax residence.

In France, since January 1, 2018, income from movable capital as well as capital gains from securities sales are subject, when taxed, to a flat-rate withholding tax (PFU) of 12.8%, to which social security contributions of 17.2% are added, making a total rate of 30%.

However, you can choose, when declaring your income, for a global taxation of these income and gains at the progressive income tax rate by checking box 2OP. You may be exempted from the portion corresponding to the flat-rate withholding tax of 12.8% for income tax purposes if your reference fiscal income for year N-2 was less than €25,000 (€50,000 if you are married). When making your declaration, you have the option to maintain the choice for taxation at 30%, or to submit your capital gains to the progressive income tax rate (to which 17.2% social security contributions will be added).

➡️ Search for previous reviews of chez Loanch

A real estate crowdfunding operation involves several categories of risks:

➡️ Operational Risk: human errors, incompetence, material shortages, delivery delays, poor management, accidents on site, provider bankruptcy...

➡️ Technical Risk: unpleasant surprises during soil and foundation studies, pollution, thermal, acoustic issues...;

➡️ Administrative and Legal Risk: difficulties in obtaining a fully cleared building or development permit, administrative authorizations, Financial Completion Guarantees, Construction Insurance, or All-Risks Site insurance, compliance of sales documents, poorly assessed urban planning authorizations;

➡️ Financial Risk: poor cost analysis, budget overruns, lower profit margins, obtaining bank credit, etc.;

➡️ Commercial Risk: insufficient pre-marketing, insufficient local market study (prices, needs, location...), delays in lot sales (commercialization), neglected suspensive conditions, unfavorable market evolution, risky sales strategy, overly optimistic exit prices, etc.

Beyond the analysis of the real estate project itself, crowdfunding platforms examine the financial and operational strength of the companies participating in the operation, which also face potential risks, mainly financial.

The evaluation thus focuses on numerous criteria, including:

➡️ Legal and Financial: capital structure, ongoing disputes, income statements and financial statements, solvency, profitability, liquidity, level of equity, etc.

➡️ Operational: organizational chart, experience of the executives, history of successfully completed operations, quality of previous programs, reputation, etc.

➡️ Financial Statements: financial statements (balance sheet and income statement) of the operator must be analyzed to determine its financial health.

➡️ Fraud: The operator may file for bankruptcy fraudulently or abscond with funds, which is why guarantees on cash flows are necessary.

Even with good preparation, it is impossible to anticipate climatic events (flooding, frost, storms...), macroeconomic factors such as sudden changes in property prices or interest rates, high inflation, etc., or legislative changes (regulatory modifications, taxation changes...), or situations of war. These risks are difficult to control. It is essential that operators have taken out the necessary insurance and that sufficient financial margin is planned to cope with potential contingencies.

The votes take place in the Objectif-Renta Club.

By joining the club, you join a community of investors driven by the same interests and passions.