Finbee is a Pear-2-Pear P2P and crowdfunding platform created in 2015 in Lithuania. It connects individuals and businesses seeking loans with investors looking for diversified investment opportunities. The loans include business loans as well as consumer loans. The investor holds a simple fixed-rate loan. It is a classic debt instrument for peer-to-peer (P2P) personal loans. They pay interest set at issuance on a predefined schedule until maturity. Business loans (P2B) are also offered on the platform. The vast majority of them have an amortization schedule like consumer loans, with some being repaid at the end of the term with a lump-sum payment.

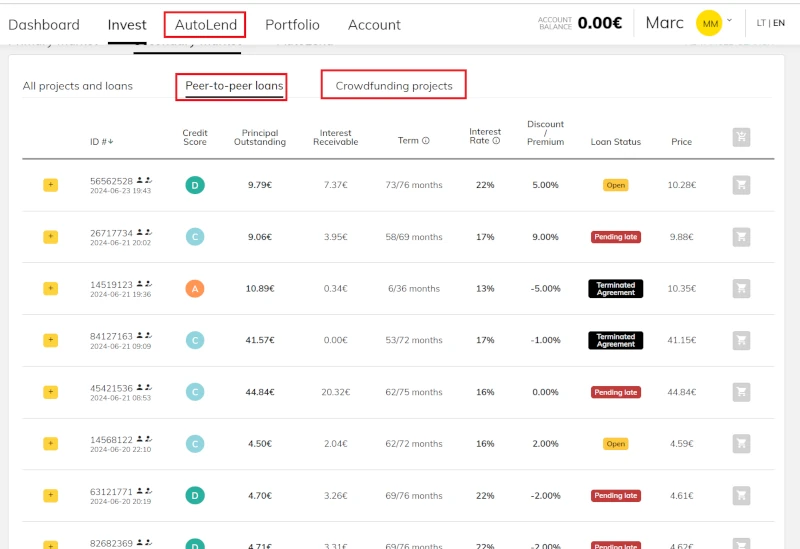

From the dashboard, you can choose the type of loans to invest in.

Finbee has a secondary market that allows you to sell your loans or buy existing loans. It is therefore possible to buy loans and put them up for sale as soon as you wish at the price you want.

Finbee has an auto-investment feature. The simplest way to start is by choosing a predefined profile: Conservative, Balanced, or Progressive. Finbee will automatically invest available funds in projects based on your settings. You can adjust the settings at any time.

The vast majority of business loans come with a personal guarantee from the principal shareholder of the borrowing company, meaning that recovery is pursued from both the company and the guarantor in the event of default.

There is €74,409,230 of total investment on this platform

▪ Number of investors: 22,751

▪ Number of projects overdue by more than 6 months: 470 projects out of a total of 7,058

▪ Number of projects in definitive loss: No definitive loss

▪ Key figures: €6.2 million in consumer loans and €7.4 million in business loans

▪ Platform news: New platform

▪ Average return: Consumer loans 16.3%, business loans 13.8%.

▪ Total interest paid: €5.32 million

▪ Total amount invested: Consumer loans: €84.9 million and Business loans €63.6 million

▪ Amounts invested by investors monthly: €2.33 million for business loans and €1.44 million for consumer loans.

The investor holds a simple fixed-rate loan. It is a classic debt instrument for peer-to-peer personal loans (P2P). They pay interest fixed at issuance according to a predefined periodicity until maturity.

This review is proposed by Marc BluerSky on

This review is proposed by Marc BluerSky on

Il y a 74.409.230€ de montant total investi sur cette plateforme

▪ Nombre d'investisseurs : 22751

▪ Montant de projets en retard de plus de 6 mois : 470 projets sur un total de 7058

▪ Montant de projets en perte de définitive : Pas de pertes définitives

▪ Chiffres clés : 6,2 millions d'euros de prêts à la consommation et 7,4 millions d'euros pour les prêts aux entreprises

▪ Actualité de la plateforme : Nouvelle plateforme

▪rendement moyen : Prêts à la consommation 16,3%, prêts aux entreprises 13,8%.

▪ Total des intérêts payés : 5,32 M€

▪ Montant total investi : Prêts à la consommation : 84,9M€ et Prêts aux entreprises 63,6M€

▪ Montants investis par les investisseurs mensuellement : 2,33M€ pour les prêts aux entreprises et 1,44 M prêts à la consommation.

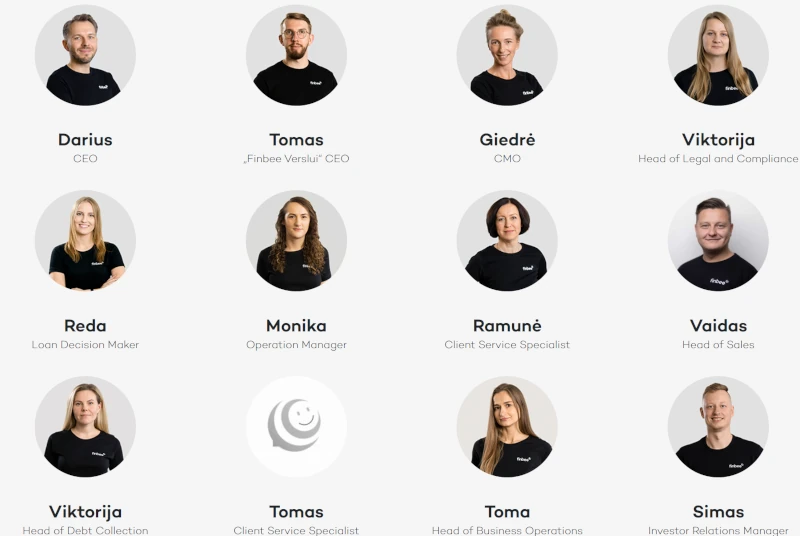

The CEO is Darius Noreika, CFA. He has been working at Finbee since 2015. Here is the Finbee team.

The average expected yield of projects is 15.3%

Yields are calculated based on the projects analyzed on this site and not on all projects.

⚠️ The higher the yield, the higher the risk.

🚫 Finbee has no buy back guarantee

In P2P lending A buyback guarantee is a guarantee provided by a loan originator regarding a specific loan. If repayment of that particular loan is delayed by more than a specified number of days (usually 60), then the loan originator is obligated to buy back the loan.

The delay rate for more than 6 months at Finbee is 15.00%.

The delayed time is computed based on the contractual date and not target date

The permanent loss rate at Finbee is 0.00%.

The minimum amount to invest is 10€.

Finbee has a very low minimum amount to invest

🌎 The financial income are taxable in the investor's country of tax residence.

In France, since January 1, 2018, income from movable capital as well as capital gains from securities sales are subject, when taxed, to a flat-rate withholding tax (PFU) of 12.8%, to which social security contributions of 17.2% are added, making a total rate of 30%.

However, you can choose, when declaring your income, for a global taxation of these income and gains at the progressive income tax rate by checking box 2OP. You may be exempted from the portion corresponding to the flat-rate withholding tax of 12.8% for income tax purposes if your reference fiscal income for year N-2 was less than €25,000 (€50,000 if you are married). When making your declaration, you have the option to maintain the choice for taxation at 30%, or to submit your capital gains to the progressive income tax rate (to which 17.2% social security contributions will be added).

➡️ Search for previous reviews of chez Finbee

A real estate crowdfunding operation involves several categories of risks:

➡️ Operational Risk: human errors, incompetence, material shortages, delivery delays, poor management, accidents on site, provider bankruptcy...

➡️ Technical Risk: unpleasant surprises during soil and foundation studies, pollution, thermal, acoustic issues...;

➡️ Administrative and Legal Risk: difficulties in obtaining a fully cleared building or development permit, administrative authorizations, Financial Completion Guarantees, Construction Insurance, or All-Risks Site insurance, compliance of sales documents, poorly assessed urban planning authorizations;

➡️ Financial Risk: poor cost analysis, budget overruns, lower profit margins, obtaining bank credit, etc.;

➡️ Commercial Risk: insufficient pre-marketing, insufficient local market study (prices, needs, location...), delays in lot sales (commercialization), neglected suspensive conditions, unfavorable market evolution, risky sales strategy, overly optimistic exit prices, etc.

Beyond the analysis of the real estate project itself, crowdfunding platforms examine the financial and operational strength of the companies participating in the operation, which also face potential risks, mainly financial.

The evaluation thus focuses on numerous criteria, including:

➡️ Legal and Financial: capital structure, ongoing disputes, income statements and financial statements, solvency, profitability, liquidity, level of equity, etc.

➡️ Operational: organizational chart, experience of the executives, history of successfully completed operations, quality of previous programs, reputation, etc.

➡️ Financial Statements: financial statements (balance sheet and income statement) of the operator must be analyzed to determine its financial health.

➡️ Fraud: The operator may file for bankruptcy fraudulently or abscond with funds, which is why guarantees on cash flows are necessary.

Even with good preparation, it is impossible to anticipate climatic events (flooding, frost, storms...), macroeconomic factors such as sudden changes in property prices or interest rates, high inflation, etc., or legislative changes (regulatory modifications, taxation changes...), or situations of war. These risks are difficult to control. It is essential that operators have taken out the necessary insurance and that sufficient financial margin is planned to cope with potential contingencies.

The votes take place in the Objectif-Renta Club.

By joining the club, you join a community of investors driven by the same interests and passions.