Mintos is a P2P lending platform, one of the biggest players in this market. It also offers investments in fractional real estate. Mintos is the European leader in P2P marketplaces. The platform has been around since 2015. Its headquarters are in Latvia. The platform's founders are Martins Sulte and Martins Valters. The minimum investment per loan: 50 euros. Minimum withdrawal: 50 euros within 24 hours. Mintos has a secondary market. Mintos charges a commission of 0.85% on the selling price on this market. It is possible to invest simply and automatically, or to select projects, depending on what is desired.

Mintos offers to invest in fractional real estate through bonds. The investor then receives rental income as well as a potential capital gain upon resale. The entry ticket is 50 euros, which is low. The maturity of the bonds is 10 to 25 years. As long as tenants pay their rent, the investor receives rental income.

It is possible to resell the bonds whenever desired on the secondary market and at the desired price. This stands out from French fractional real estate, where it is not possible to resell bonds before maturity.

The estimated rental yield for the first property is 5%, which is reasonable and within the average rental yields in fractional real estate. Beyond the rental yield, property appreciation is possible, and thus a capital gain in case of resale. However, it is difficult to estimate the evolution of real estate prices in the medium/long term.

Payments are made every month.

The bonds are issued by SIA Mintos Finance, a company under Latvian law. The issued bond is linked to the property to be financed. The property may be located in a different country, which is the case for the first property located in Austria. The structure implemented allows for a bond backed by a real estate asset.

Mintos offers to invest in portfolios composed of ETFs. There are 4 different profiles: core 10, core 35, core 60, and core 90. The entry ticket is 50 euros.

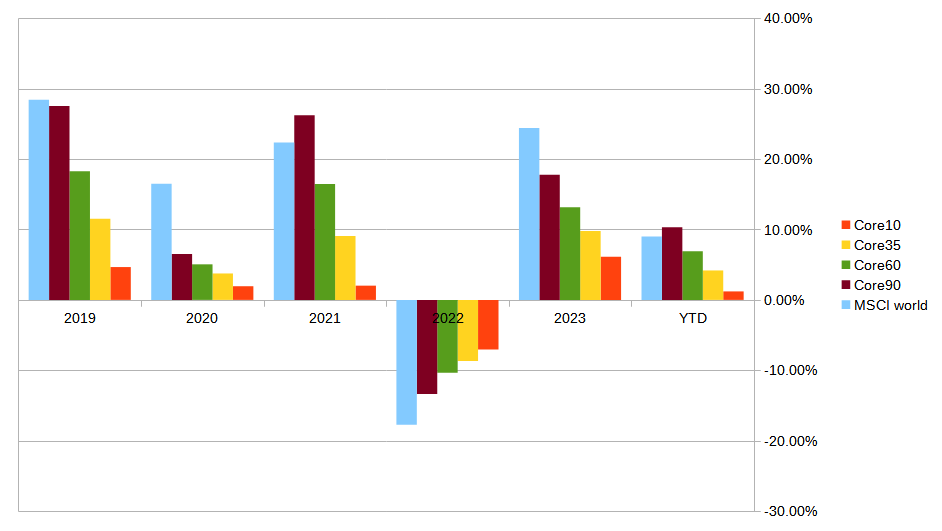

The historical yield differs depending on the portfolios. On the graph below, you can compare the annual yield of Mintos ETFs with the performance of the MSCI World. The volatility of Mintos ETFs is generally lower than that of the MSCI World. This is due to bond ETFs, which are less volatile than equity ETFs.

| Ticker | ISIN | Name |

|---|---|---|

| IE3E | IE000AK4O3W6 | iShares EUR Corporate Bond 0-3yr ESG UCITS ETF EUR (Acc) |

| IS3N | IE00BKM4GZ66 | iShares Core MSCI Emerging Markets IMI UCITS ETF |

| JREG | IE00BF4G6Y48 | JPMorgan Global Research Enhanced Index Equity (ESG) UCITS ETF |

| PRAB | LU2233156582 | Amundi Prime Euro Gov Bonds 0-1y UCITS ETF DR |

| PRAW | LU2089238203 | Amundi Prime Global UCITS ETF |

| VECA | IE00BGYWT403 | Vanguard EUR Corporate Bond UCITS ETF |

| VGEA | IE00BH04GL39 | Vanguard EUR Eurozone Government Bond UCITS ETF |

| XHYA | LU1109943388 | Xtrackers EUR High Yield Corporate Bond UCITS ETF 1C |

I started investing in 2021 and I am reviewing my investments here in 2023.

Bond-type fractional real estate involves financing a real estate project and receiving both rental income and potential capital gains in case of resale. The returns are lower than those from traditional crowdfunding because these are rental investments rather than property trading projects. On most platforms, the projects are associated with first-rank mortgages, the gold standard in real estate security.

Vous détenez une obligation avec un taux fixe sur chacun des projets mais contrairement à une obligation simple, le capital remboursé à l'échéance dépend de l'évolution du prix du bien. En l'occurrence, vous pouvez obtenir une plus-value si le marché s'apprécie. L'échéance des obligations est de long terme, en général entre 8 et 10 ans et potentiellement renouvelable. Les intérêts ou coupons sont fixés lors de l'émission obligataire et sont versés selon une périodicité prédéfinie jusqu'à son échéance. Une obligation est un titre financier réglementé par l'autorité des marchés financiers (AMF).

This review is proposed by Damien Cuyala on

This review is proposed by Damien Cuyala on

Mintos est le leader Européen des places de marchés de type P2P. La plateforme existe depuis l'année 2015 Son siège est en Lettonie Les fondateurs de la plateforme sont Martins Sulte et Martins Valters. La plateforme à 160 employés. Investissement minimum par prêt : 50 euros Retrait minimum : 50 euros en 24 heures Mintos dispose d'un marché secondaire. Mintos prélève une commission de 0.85% sur le prix de vente de ce marché. Il est possible d’investir de manière simple et automatisée, ou de sélectionner ses projets, en fonction de ce qui est souhaité.

Il y a 10 milliards d'euros de montant total investi sur cette plateforme

Montant de projets en retard de plus de 6 mois : 3,245 M€

Montant de projets en défaut : 575766€

Le rendement moyen chez Mintos est de 11.35%

Chiffres clés : 1,049 M€ de bénéfices sur l'année 2023

Actualité de la plateforme : Licence EU N°06.06.08.719/534.

Actualité sur les émetteurs de prêts : Investissement possible dans plus de 26 pays dans 12 devises différentes, attention aux risques en matière de taux de change.

Evolution du nombre de prêts totaux mensuels de la plateforme : +100M€ en mars 2023

rendement moyen : 11,35%

Total des intérêts payés : 242,2 M€

Montant total investi : + augmentation/diminution

Montants investis par les investisseurs mensuellement : 100M€/mois

Santé financière de la plateforme (Rapport financier si il existe) : En bénéfice de + de 1,049M€ sur 2023

Pour le moment je n'ai pas encore investi sur cette plateforme.

Il est possible d'y investir dès 50€

Pour cet investissement il y a 0 % de commission. Il n'y a aucun frais pour acheter, détenir ou vendre des ETF chez Mintos.

Le portefeuille ETF Mintos est composé à 90 % d'actions mondiales et de 10 % en obligations européennes.

Le portefeuille offre un rendement moyen de 5.8% annuellement.

Les investisseurs possèdent l'ETF en entier ou bien une fraction de celui-ci, en fonction de leur montant d'investissement et de la répartition de leur portefeuille

Composition de l'ETF :

Actions des marchés développés 60%

Amundi Prime Global UCITS ETF

ISIN: LU2089238203

Volume du fonds € 688 M

Frais de gestion 0,05 %

Actions ESG des marchés développés 20%

JPMorgan Global Research Enhanced Index Equity (ESG) UCITS ETF

ISIN: IE00BF4G6Y48

Volume du fonds € 2 247 M

Frais de gestion 0,25%

Actions des marchés émergents 10%

JPMorgan Global Research Enhanced Index Equity (ESG) UCITS ETF

iShares Core MSCI Emerging Markets IMI UCITS ETF

ISIN: IE00BKM4GZ66

Volume du fonds € 16 759 M

Frais de gestion : 0,18%

Obligations d'État 6%

Vanguard EUR Eurozone Government Bond UCITS ETF

ISIN: IE00BH04GL39

Volume du fonds € 1 770 M

Frais de gestion : 0,07%

Obligations d'entreprises industrielles, de services publics et financières en euros 5%

Vanguard EUR Corporate Bond UCITS ETF

ISIN: IE00BGYWT403

Volume du fonds € 1 650 M

Frais de gestion : 0,09%

Le seul coût est celui du TER (c'est-à-dire le ratio des frais totaux ou Total Expense Ratio en anglais) de l'ETF, qui est en moyenne inférieur à 0,1% pour les ETF que nous avons sélectionnés. Ce TER est déjà intégré dans la structure de prix de l'ETF et est directement géré par les fournisseurs d'ETF (c'est-à-dire Vanguard, iShares) pour couvrir tous les coûts opérationnels associés. Le TER est payé, quel que soit le courtier par lequel vous achetez ces ETF.

En fonction du profil de risque de l'investisseur et de ses objectifs, Mintos propose une statégie d'investissement sur plusieurs ETF. Voici un exemple.

The average expected yield of projects is 11.35%

Yields are calculated based on the projects analyzed on this site and not on all projects.

⚠️ The higher the yield, the higher the risk.

✅ Mintos has a buy back guarantee

In P2P lending A buyback guarantee is a guarantee provided by a loan originator regarding a specific loan. If repayment of that particular loan is delayed by more than a specified number of days (usually 60), then the loan originator is obligated to buy back the loan.

⚠️ Information about delays of more than 6 months is not available for Mintos

⚠️ Information on permanent losses is not available for Mintos

The minimum amount to invest is 50€.

Mintos has a low minimum amount to invest.

🌎 The financial income are taxable in the investor's country of tax residence.

In France, since January 1, 2018, income from movable capital as well as capital gains from securities sales are subject, when taxed, to a flat-rate withholding tax (PFU) of 12.8%, to which social security contributions of 17.2% are added, making a total rate of 30%.

However, you can choose, when declaring your income, for a global taxation of these income and gains at the progressive income tax rate by checking box 2OP. You may be exempted from the portion corresponding to the flat-rate withholding tax of 12.8% for income tax purposes if your reference fiscal income for year N-2 was less than €25,000 (€50,000 if you are married). When making your declaration, you have the option to maintain the choice for taxation at 30%, or to submit your capital gains to the progressive income tax rate (to which 17.2% social security contributions will be added).

➡️ Search for previous reviews of chez Mintos

A real estate crowdfunding operation involves several categories of risks:

➡️ Operational Risk: human errors, incompetence, material shortages, delivery delays, poor management, accidents on site, provider bankruptcy...

➡️ Technical Risk: unpleasant surprises during soil and foundation studies, pollution, thermal, acoustic issues...;

➡️ Administrative and Legal Risk: difficulties in obtaining a fully cleared building or development permit, administrative authorizations, Financial Completion Guarantees, Construction Insurance, or All-Risks Site insurance, compliance of sales documents, poorly assessed urban planning authorizations;

➡️ Financial Risk: poor cost analysis, budget overruns, lower profit margins, obtaining bank credit, etc.;

➡️ Commercial Risk: insufficient pre-marketing, insufficient local market study (prices, needs, location...), delays in lot sales (commercialization), neglected suspensive conditions, unfavorable market evolution, risky sales strategy, overly optimistic exit prices, etc.

Beyond the analysis of the real estate project itself, crowdfunding platforms examine the financial and operational strength of the companies participating in the operation, which also face potential risks, mainly financial.

The evaluation thus focuses on numerous criteria, including:

➡️ Legal and Financial: capital structure, ongoing disputes, income statements and financial statements, solvency, profitability, liquidity, level of equity, etc.

➡️ Operational: organizational chart, experience of the executives, history of successfully completed operations, quality of previous programs, reputation, etc.

➡️ Financial Statements: financial statements (balance sheet and income statement) of the operator must be analyzed to determine its financial health.

➡️ Fraud: The operator may file for bankruptcy fraudulently or abscond with funds, which is why guarantees on cash flows are necessary.

Even with good preparation, it is impossible to anticipate climatic events (flooding, frost, storms...), macroeconomic factors such as sudden changes in property prices or interest rates, high inflation, etc., or legislative changes (regulatory modifications, taxation changes...), or situations of war. These risks are difficult to control. It is essential that operators have taken out the necessary insurance and that sufficient financial margin is planned to cope with potential contingencies.

The votes take place in the Objectif-Renta Club.

By joining the club, you join a community of investors driven by the same interests and passions.